Economic Outlook

Policies Shift; the Economy Wobbles

- Strong US growth shows signs of slowing

- Policy uncertainty impacting confidence

- The Fed is on hold

- Progress on inflation stalled

Growth

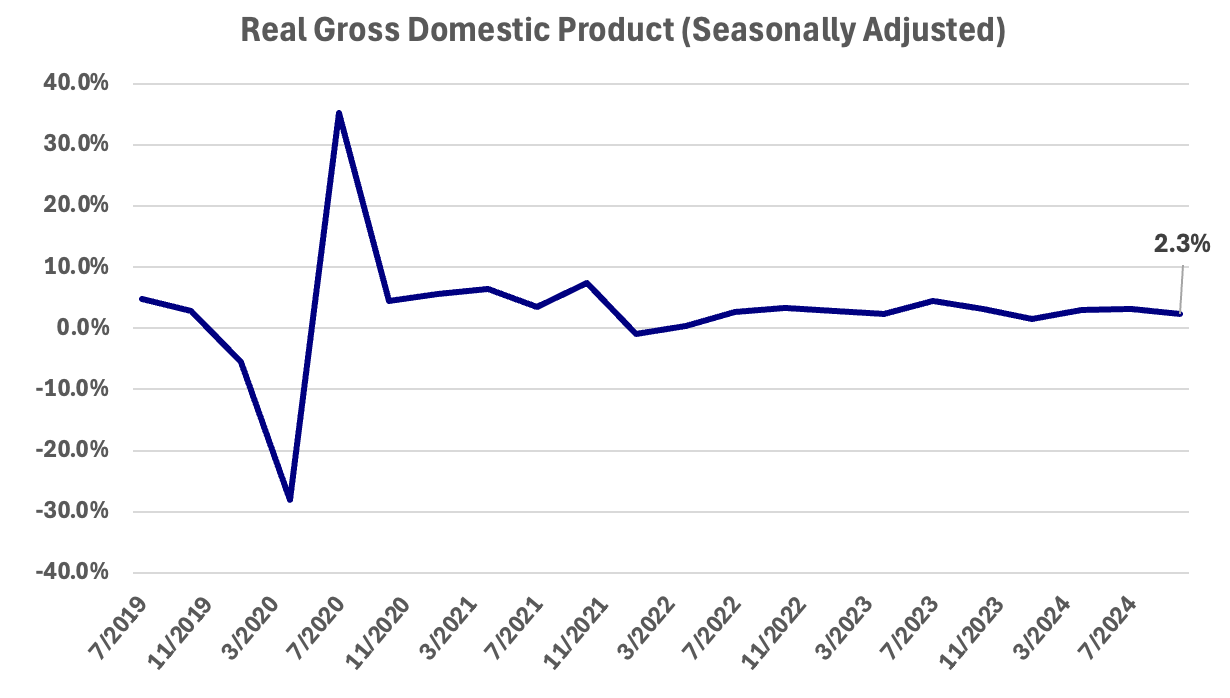

- US Real GDP came in at 2.3% for Q4 2024

- Sales and consumer spending down in early 2025

- Income and labor market remain strong

- Uncertainty is undermining confidence

After posting solid growth of 2.3% in the fourth quarter of 2024, as measured by real GDP, the US economy is now showing signs of slowing down. Consumer spending, a key driver of US economic growth, declined 0.2% in January or $30.7 billion nationally. Key declines were in auto purchases and other durable goods, but services spending expanded. Consumer confidence also declined. Personal income rose at a monthly rate of 0.9% in January, a strong result, and the different trajectories of income and spending were reflected in a higher savings rate (4.6%). On average, the US consumer earned more in January but spent less. Retail sales were down sharply in January, and a slight bounce in February failed to make up for the loss. January sales were the worst in almost four years. The Atlanta Fed’s GDPNow model, which incorporates several current economic indicators in an effort to estimate US GDP in real time, is now negative for the first quarter of 2025. Although this tool is not a precise predictor of actual GDP, which is only available after quarter-end, it is directionally correct in summarizing incoming economic data.

Economic momentum was strong coming into 2025, and few economists presently see the US sinking into recession. However, persistent inflation, geopolitical instability, and a host of policy shifts on tariffs are undermining the confidence necessary to sustain consumer spending and business investment. The labor market remains strong, as reflected in low unemployment and strong monthly additions to payrolls. But inflation has proven persistent at levels above the Fed’s 2% target. The US trade deficit, which is a subtraction from GDP, widened in December and hit a new record for all of 2024. One explanation of that outcome is that many importers of goods and materials accelerated imports late last year in anticipation of threatened new tariffs.

Expressions of concern about the trajectory of the economy are focused on the uncertainty that attaches to significant policy shifts undertaken by the new President and his administration. While policy shifts are typical of new administrations, especially when the changeover is from one party to another, the changes that have been initiated by this administration are notable for their speed, breadth, and novelty.

The most significant economic policy changes are in the areas of tariffs, federal spending, regulation, and immigration. Changes in approach to geopolitical issues are adding to the uncertainty. Former alliances and practices are either being questioned or abandoned. Many of our prior assumptions about governance are being challenged. Even the assault on federal spending, which may be a positive in the long run, appears brusque and unpredictable.

Tariffs at the levels promised by the new administration do have the potential to slow growth and contribute to inflation. The cost of tariffs is typically passed on to the consumer in the form of price increases. To the extent that they might be partially absorbed in profit margins, they can also negatively impact business investment. Much of the manufacturing that’s based in the US uses either parts or materials imported from abroad and will therefore be impacted by new tariffs. Retaliation to US tariffs by other countries can also negatively impact US farm revenues and overall US exports. While the US runs a trade deficit with respect to material goods, it runs a trade surplus with respect to services, and those could also be impacted by retaliatory tariffs by other nations.

Not all the news is bad. Proposed reductions in government spending have the clear potential to reduce the growth of the federal deficit. Deficit spending in the US has been on an unsustainable trajectory for a long time. Excessive deficit spending absorbs capital that might otherwise be invested in private enterprise and tends to push up interest rates. Markets have a large but finite appetite for bonds, and an ever-expanding deficit funded by the sale of Treasuries can crowd out private-sector credit. However, because government spending is 23% of US GDP, spending reductions can also reduce economic growth in the near term.

Stronger enforcement of immigration laws could impact the cost and availability of labor, especially in industries like agriculture, hospitality, and construction. The expansion of our labor force has been a source of economic strength in recent years. The US labor force has expanded by over 6 million since COVID, and a significant percentage of those workers were born outside the US. While enforcement of immigration laws is an appropriate national objective, demographic flexibility has given the US an economic advantage over the economies of Europe, Japan, and even China, all of which are dealing with more rapidly aging workforces.

A relaxation of government regulation should be supportive of economic growth. Reduced regulation simplifies decision-making, reduces costs, and encourages investment. This effect may be especially pronounced in banking and finance, energy development, and manufacturing. Its full impact may take some time to develop.

On balance, it is not the direct impacts of policy changes that hold the greatest risk to continued US growth. Rather, it is the uncertainty created by an environment of abrupt and unpredictable change that undermines confidence. And this effect is showing up strongly in the surveys of consumer and business confidence, as well as in surveys of future expectations for growth and inflation. Consumers and business managers who lack confidence in the future are less likely to commit to new business investments or expansions in their payrolls.

Employment

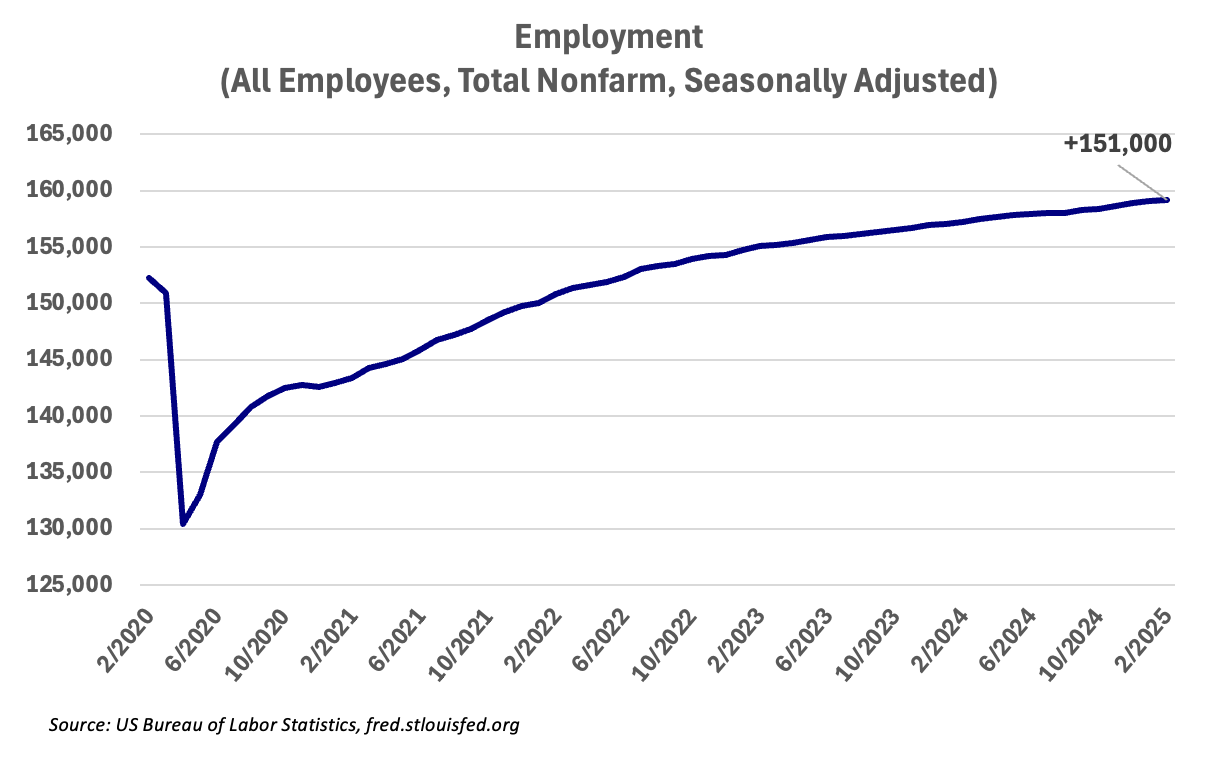

- Payrolls increased 151,000 in February

- Unemployment ticked up to 4.1%

- Wage increases were moderate

The US economy added 151,000 jobs in January, a solid result. The unemployment rate was little changed at 4.1%. As a benchmark, the US needs to add about 100,000 jobs per month just to keep up with population growth, so measures about that level indicate a healthy rate of hiring. Average hourly wages were up 4.0% year-over-year, which is not a rate of increase that would negatively impact overall inflation.

Most of the changes in the overall employment situation during this tightening cycle have occurred in job openings. In the early months following COVID, there were more than two job openings for every unemployed person; today, there is just under one. A reduction in job openings is much less painful to the economy and its participants than an increase in unemployment, a result that is very typical for a tightening cycle when the Fed is increasing rates to combat inflation.

Stricter enforcement of immigration laws may tighten the availability of labor. Such actions could increase the number of open positions and fuel additional increases in wages. So far, no such effect is showing up in the numbers. Industries that could see a greater impact from such policies include agriculture, construction, healthcare, and hospitality.

There may be challenges in the US economy, but those challenges are not presently showing up in the data relating to employment and unemployment.

Inflation

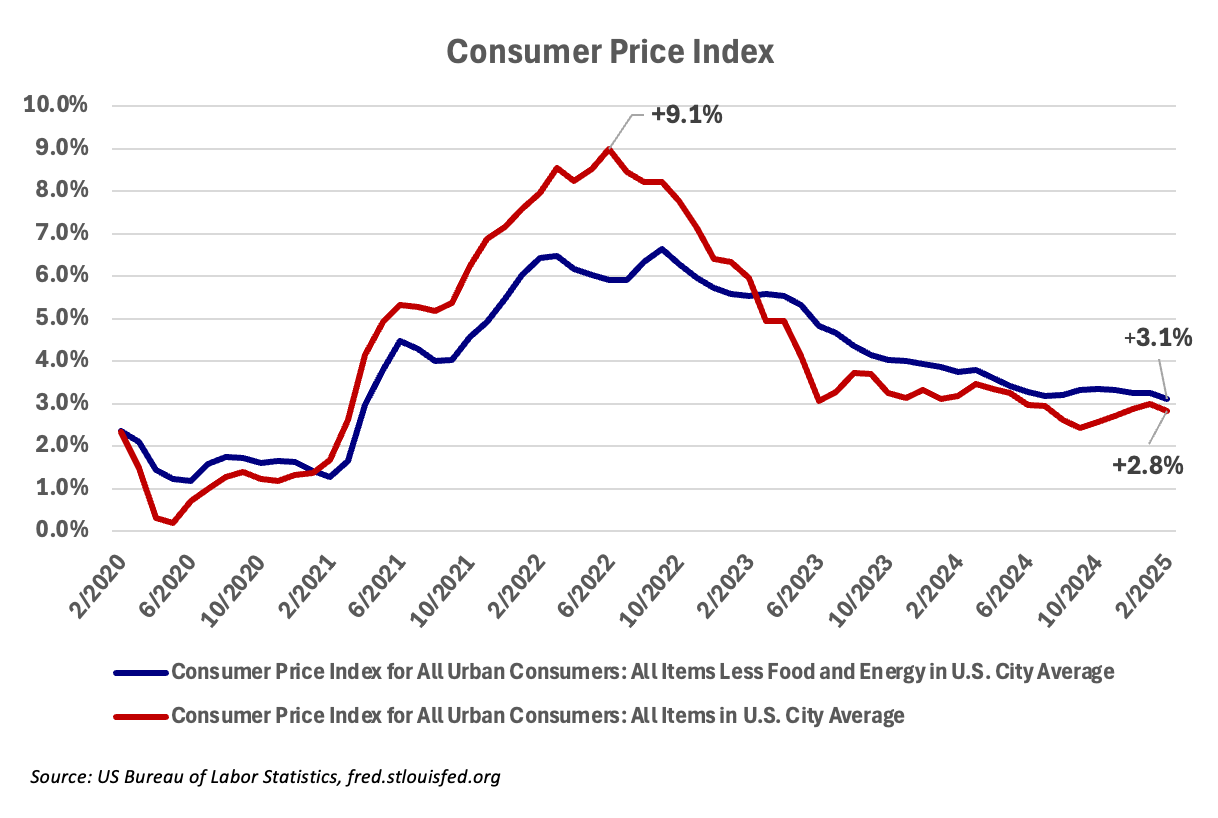

- February CPI softer than January at 2.8%

- Core CPI came in at 3.1%

- Inflation has stalled above 2%

Headline CPI came in at 2.8% in February, slightly lower than the 3% recorded in January. The “core” inflation number, which excludes food and energy, came in at 3.1%. Both numbers are above the Fed’s target of 2%. Improvements over the January numbers came from slower growth in food and energy prices as well as core goods and services. While the month-to-month numbers have been showing small moves up and down, sustained improvement in inflation has not occurred since mid-2024. Inflation appears stuck at levels above the Fed’s stated target. The broad measures of inflation were helped in January by a slight decline in gasoline and a leveling out of food prices, despite a sharp rise in the well-publicized price of eggs. Core inflation was helped by lower new car prices, as well as a slowing of price increases for used cars and trucks. Pharmaceuticals were flat. Shelter costs moderated slightly, especially in the form of rent expense. Overall, housing costs remain high.

The consumer’s perception of inflation remains elevated because prices remain elevated. Inflation only measures the rate of change in the overall price levels, not price levels themselves. Inflation could moderate down to the Fed’s 2% goal and prices would still be high relative to our pre-COVID experience. Inflation has moderated a great deal since hitting 9% halfway through 2022, but for now, it remains stuck above the Fed’s target and prices remain high. New tariffs will add to the cost of imported goods and the cost of goods that incorporate imported parts or materials.

Interest Rates

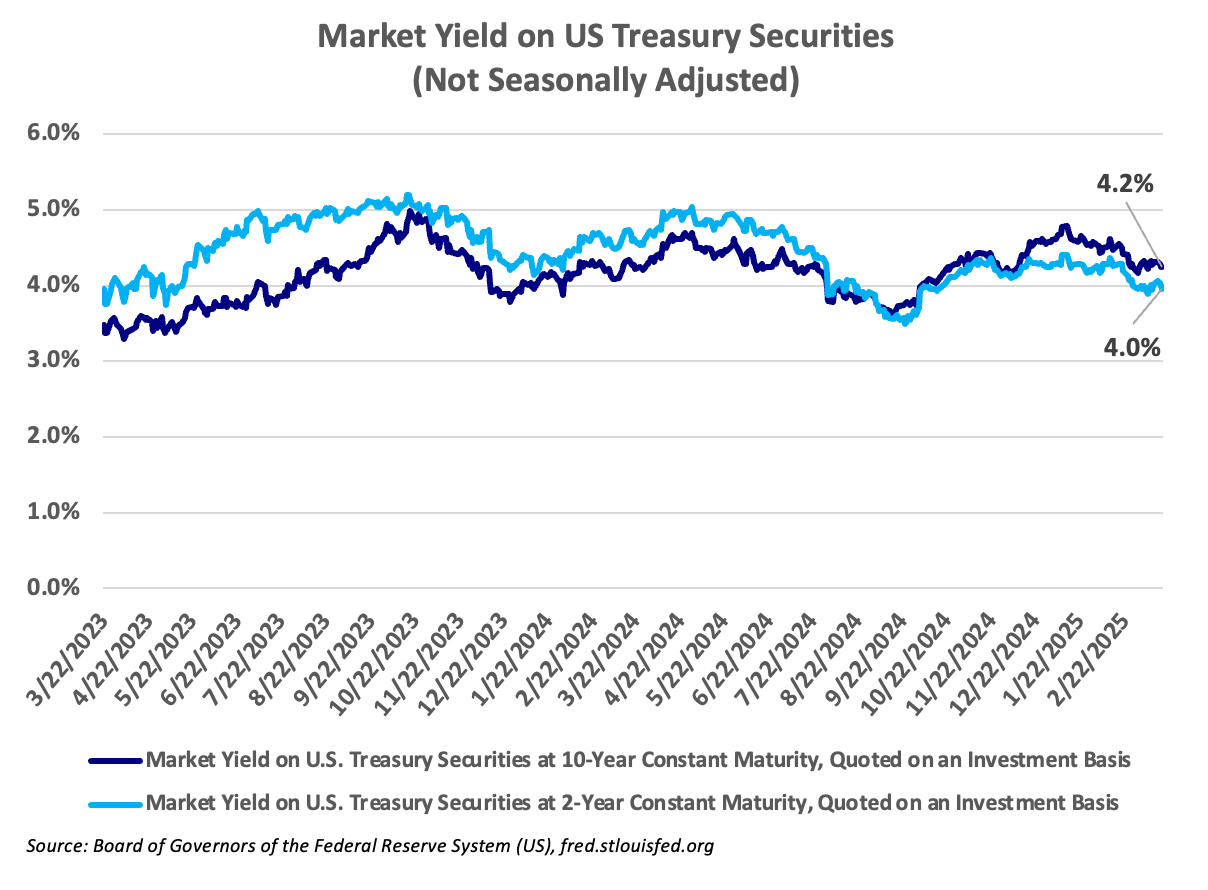

- Federal Reserve is on hold

- Short-term target rate held at 4.25–4.50%

- Key 10-year Treasury rate has fallen to 4.25%

The Federal Reserve’s Open Market Committee met on March 18 and 19 and left their target for short-term rates unchanged. The upper bound for that target is 4.50%. It had been 5.50% last September, before the rate cuts in the fall of 2024. This is the second consecutive meeting where the Fed has left rates unchanged. In its press release, the Committee continued to describe the pace of economic activity as “solid;” it also indicated that inflation remains “somewhat elevated.” In perhaps the most telling change in their statement, they indicated that “uncertainty around the economic outlook has increased.”

The Summary of Economic Projections (SEP) was also released after this meeting. These summary statistics, which reflect each member’s views on future trends in the economy, are only released four times each year. The median forecast for GDP growth in 2025 was reduced from 2.1% to 1.7% by the members of the Committee. Their median forecast for core PCE inflation rose from 2.5% to 2.8% for the same period. The median forecast for unemployment at the end of 2025 increased from 4.3% to 4.4%—not a large change, but up from the current rate of 4.1%. The median forecast for rate cuts this year remained unchanged at two 0.25% cuts, but four members indicated an expectation for no additional cuts this year.

A combination of lower growth, higher unemployment, and higher inflation would pose a very tough dilemma for the Fed for the remainder of 2025. If inflation ticks higher, would they hold or even raise rates as they have in the past to combat inflation? Remember, their stated goal is 2% inflation. If growth declines and unemployment rises closer to 5%, would they cut rates to stimulate growth? Overall, the change in the SEP forecast gives off a whiff of stagflation—an ugly condition where growth stalls, but inflation remains elevated. The Fed regularly references its “dual mandate”—price stability (low inflation) and full employment. Stagflation, even in a mild form, would be the toughest set of circumstances for the Fed to address.

Overall monetary conditions remain somewhat restrictive, meaning that interest rates are still above where they would be if growth, employment, and inflation were in balance. The Fed is leaving rates where they are because they believe there is still room for improvement on inflation and because the labor market is not yet sounding alarms. A change on either of these fronts could change their posture.

Similar to other decision-makers in this economy, the Fed is on hold because of their own uncertainty regarding the direction and impact of new policies on the economy. The bond market is grappling with those same uncertainties. At this writing, the 10-year Treasury yield stands at 4.25%. It had been as high as 4.79% in mid-January and as low as 3.63% last September. The rate on the 10-year Treasury is the benchmark that sets most of the other interest rates in the US credit system. It is key to determining the rate for the 30-year mortgage.

Markets

- Stocks take back their post-Trump rally

- Stock market broadening out, international gains ground

- Bonds earning yields above the inflation rate

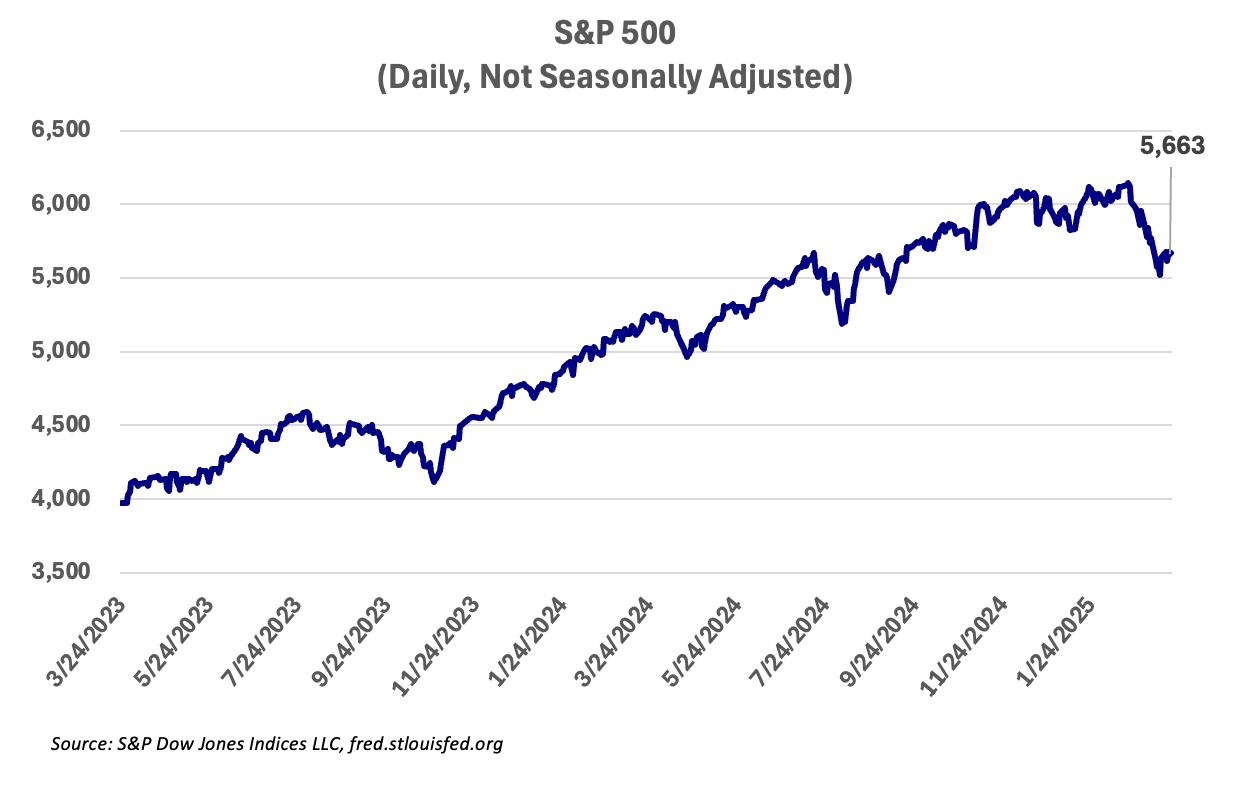

Following Donald Trump’s election victory, the stock market staged a very impressive rally; the S&P 500 rose above 6,000 for the first time, and the Dow surpassed 44,000. Those post-election gains have since been wiped out as investors grapple with the administration’s sweeping new policies. At this writing, the S&P 500 is 5.5% below its level at the first of the year and 6.4% below its recent peak. Since that index was up over 25% in 2024, inclusive of dividends, for most investors, the current weakness is a give-back of prior gains. Much of the decline in the index has been led by the same short list of technology mega-cap stocks that led the bull markets of 2023 and 2024. To a certain extent, a broadening of support away from those names may be a healthy development for this market. If so, this is also a somewhat painful path to achieving that result. International stocks, which have trailed US stocks for most of the past two years, are suddenly showing positive results relative to our domestic markets. Several European markets have staged double-digit returns so far this year as the US market has lagged. Global investors are anticipating increased government spending in Europe, particularly in the area of defense. This anticipated spending is happening in the context of a relaxation of US support for Ukraine and the NATO alliance. Some part of the break in US stock returns could be attributed to the extreme valuations they had attained over the past two years. In the aggregate, the S&P 500 is trading at about 28 times the annual earnings of its component companies. While elevated multiples have become more typical in recent decades, the long-term average PE multiple of the stock market is closer to 16.

Short-term bond yields declined with the Federal Reserve’s rate cuts at the end of 2024. They now stand at 4.36%. Intermediate-term rates had declined through September of last year in anticipation of Fed cuts, then rose through the last quarter of 2024 and into early January. For much of early January, the yield on the 10-year Treasury appeared headed for 5%. It peaked at 4.8% and has since settled back to about 4.25%, essentially even with short-term rates. The bond market will need clear and convincing evidence of restraint on deficit spending before settling into sustainably lower rates. In contrast to the recent period of ultra-low rates, intermediate bonds are now providing a yield that is meaningfully above the current rate of inflation. At these levels, they may once again play a constructive role in a conservative investor’s portfolio.

If we can help you navigate this changing business climate, please do not hesitate to contact your United Community banker. We appreciate your readership.

Learn about our economy expert.

-

This information is for informational purposes only and does not constitute investment advice.

Sources:

GDP – Bureau of Economic Analysis

Employment & Inflation – Bureau of Labor Statistics

Interest Rates – Federal Reserve

P/E S&P 500 – multpl.com

Non-Deposit investment products and services, and Insurance products and services offered through United Community Banks, Inc. are:• NOT Insured by FDIC or Any Other Government Agency;

• NOT Guaranteed by United Community Bank or any affiliate of United Community Bank;

• NOT a Deposit or Obligation;

• Subject to Risk and May Lose Value

This content is not intended as, and shall not be understood or construed as, financial advice, investment advice, or any other advice. This content is provided for informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. United Community shall not be liable for any damages of any kind relating to such information not as to the legal, regulatory, financial or tax implications of the matters referred herein. All views and opinions expressed are those of the writer/commentator and do not reflect the views or positions of United Community.