Online and Mobile Banking

Digital Banking for Your Business

Access and manage your accounts anytime, transfer funds or send payments via ACH and wire, and receive real-time account and security alerts to keep your business running smoothly and securely. Choose the service level that best meets the needs of your business.

Card Controls

- Understand your spending clearly with spending insights, recurring payment information, ‘card-on-file’ merchant identification, and more.

- Get real-time transaction alerts so you know exactly when and where your card is being used.

- View a digital card on a mobile device and easily push it to Apple Pay or Google Pay.

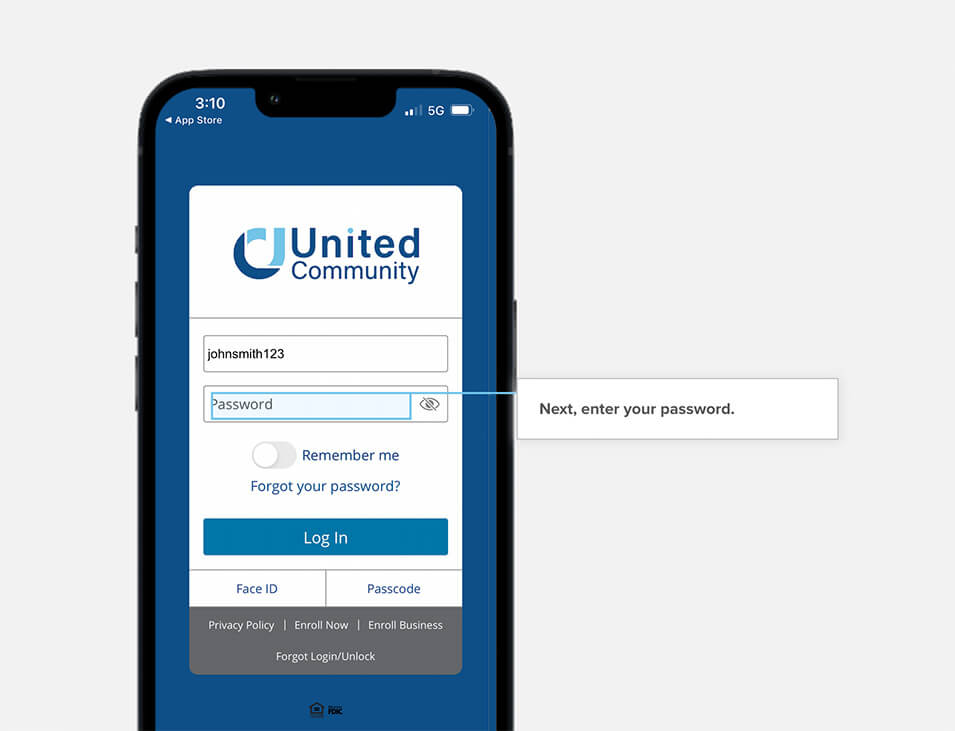

Need Help with Online Banking?

Start banking online with confidence with our new step-by-step demos.

Learn things like:

- How to enroll in online banking

- How to log in to the mobile app

- How to recover your password

- How to make a mobile deposit

- and more!

Online Banking Features

Business Bill Pay

eStatements

Alerts and Notifications

Invoicing and Payments for Small Businesses

Treasury Management

Mobile Deposits

*United Community reserves the right to restrict mobile deposit access for new online banking customers.

Learning Resources

-

Sum of Monthly Access, Additional User and Additional Account fees will not exceed $60 per month.

2 Additional fees may apply.3 Message and data rates may apply. Fees may apply for certain optional services through Business Online and Mobile Banking.

4United Community Bank (“United”) is pleased to offer digital invoicing and payment technology services through Autobooks, Inc. (“Autobooks”), a third-party provider of online accounting services. By providing your contact information, you consent to be contacted by a representative with Autobooks. United, its subsidiaries, and its affiliates are not affiliated with Autobooks. The services referenced herein are provided exclusively by Autobooks. Customer’s use of such services is solely at customer’s election and is subject to Autobooks’s terms of use in all respects. Certain restrictions and fees apply for use of the service. United and its employees may be entitled to receive fees and incentives from Autobooks based on United’s customer’s use of these services. Autobooks may have privacy and security policies that are different from United’s Privacy Policy and Security Statement. You should review the Autobooks terms of use and the privacy and security policies on the Autobooks website before you provide personal or confidential information. Please refer to the Autobooks website for its statement on security and compliance. Note: Payments initiated through Autobooks products typically post to your United account in 1-2 business days; longer delays may apply in certain instances.