Health Savings Accounts

Access Your AccountWhat’s a Health Savings Account?

The Benefits of Saving with United

Your United Health Savings Account (HSA) comes with:

- No minimum balance

- Free HSA debit card

- Digital banking access

- Personalized HSA portal with your tax savings to date, transaction details, and receipt storage

- Monthly eStatements and annual reports

- One-time $10 setup fee and $2.75 monthly service charge

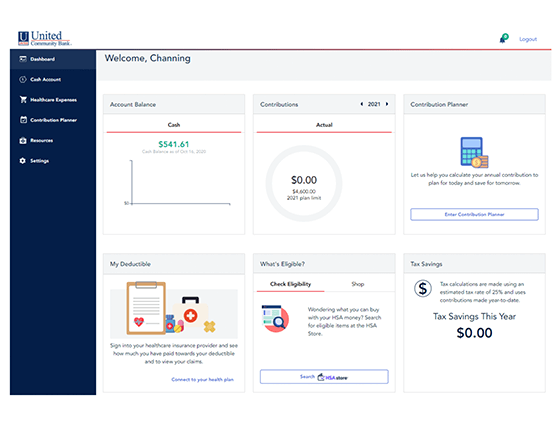

Your HSA Portal

Stay up to date with your expenses and progress at all times. Enroll in our HSA portal to:

- View your account balance, tax savings, and contributions

- Track your out-of-pocket expenses and store your receipts

- Plan your contributions to meet your current needs and see how much you can save by retirement

- Link your healthcare plan and track your deductible, out-of-pocket maximums, and medical claims

HSA Contributions

| Year | Individual/Single Coverage | Family Coverage (2+ Lives) | Catch-up Contributions2 |

|---|---|---|---|

|

Year

2024 Contributions

|

Individual/Single Coverage

$4,150

|

Family Coverage (2+ Lives)

$8,300

|

Catch-up Contributions2

$1,000

|

|

Year

2025 Contributions

|

Individual/Single Coverage

$4,300

|

Family Coverage (2+ Lives)

$8,550

|

Catch-up Contributions2

$1,000

|

-

To be eligible for an HSA account you must be enrolled in a High Deductible Health Plan (HDHP), cannot have additional healthcare coverage including Medicare or VA benefits and cannot be claimed as a dependent. HSA accounts cannot be rolled or transferred into any IRA account.

2Those age 55 and older may contribute an additional amount as shown as a catch-up contributor.